Euro Financial Crisis: No End In Sight

Market jitters over Italian insolvency are more than just another soft European economy being added to the ever-growing list of debt anchors pulling the Euro Zone into the abyss.

The Fall of Strauss-Kahn: Europe Loses its Savior?

The arrest and subsequent resignation of former IMF chief Dominique Strauss-Kahn won’t just impact the Euro sovereign debt crisis, but the wider international monetary order as well.

EU Bailouts: Round Two

A bailed out Greece and Irish Republic may have temporarily calmed the beast of rampant bond speculation, but deep fiscal rot in both Portugal and Spain has the potential to kick off a new round of European debt déjà vu.

ANALYSIS: EU eyes reform to ward off another sovereign debt crisis

October 29th, 2010 (Geopoliticalmonitor.com) - The Franco-German axis is attempting to rewrite parts of the Lisbon Treaty in an effort to avoid another Greek-style sovereign debt crisis.

UK Government Spending Cuts in Detail

A historic round of cost-cutting measures has been announced by the British government in an effort to shore up investor confidence and avoid another Greek-style sovereign debt crisis.

Currency War or Business as Usual?

The recent passage of a US law that allows for the executive branch to enact trade sanctions on China for currency manipulation stands as a clear sign that the Obama administration is getting serious about the value of the yuan.

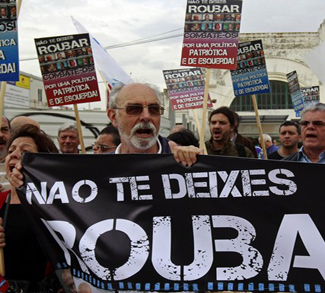

Austerity Blowback in Europe

A wave of popular discontent over austerity governments implemented by EU governments is starting to make its presence felt across Europe.

Analysis: Greek Economy Contracts

Softness in the Greek economy edged out several predictions when it was announced that it had contracted at the alarming rate of 1.8 percent in the second quarter.

ANALYSIS: German economic growth

August 13th (Geopoliticalmonitor) - A weak euro has allowed Germany to post its highest quarterly growth since unification.

Analysis: European Banks Stress Test

Today, results of the financial ‘stress test’ performed on 91 banks across Europe will be made public.