Summary

The arrival of the omicron variant generated a collective gasp from investors in developed economies, followed by a sigh of relief as early reports suggested that current vaccines – if boosted – would provide at least some semblance of protection. Yet, despite the resultant euphoria in equity markets over the past few days, omicron has already produced a slew of negative impacts such as renewed travel bans, testing regimes, and a reversal in the tentative normalization of the tourism industry. Moreover, as the variant continues to spread, so too does the risk of overburdened healthcare systems and additional lockdowns (several European countries were under severe strain even before omicron appeared).

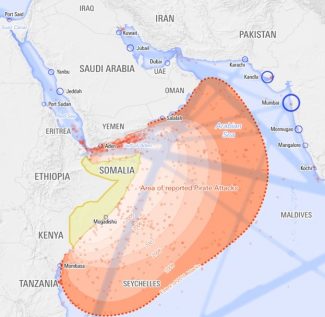

The above risks are especially pronounced for low-income countries, many of which were already straining under the weight of onerous debt burdens. For them, omicron represents an existential threat in new borrowing needs, depressed commodity prices, and further pushing back the horizon for economic normalization. Absent new efforts from G20 countries to streamline debt relief, a cascading debt crisis in the developing world remains a real possibility.