Core Insights:

- The latest US inflation data has surprised on the upside, pushing back any Federal Reserve plan to cut rates.

- Higher-for-longer interest rates will put pressure on US consumers, who have been piling on credit card debt through 2023.

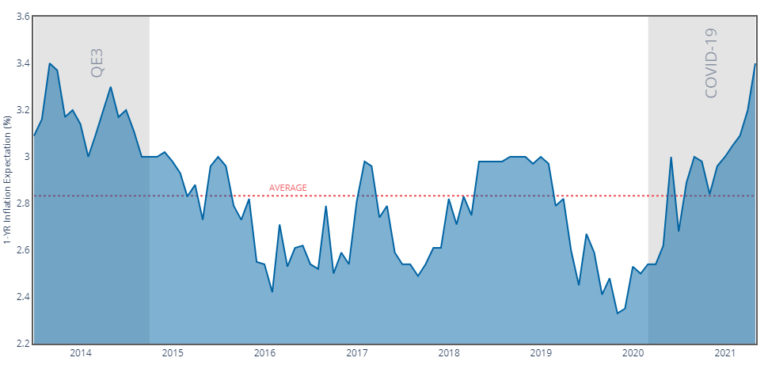

- There is historical precedent of a twin-peaked inflation crisis in the 1970s.

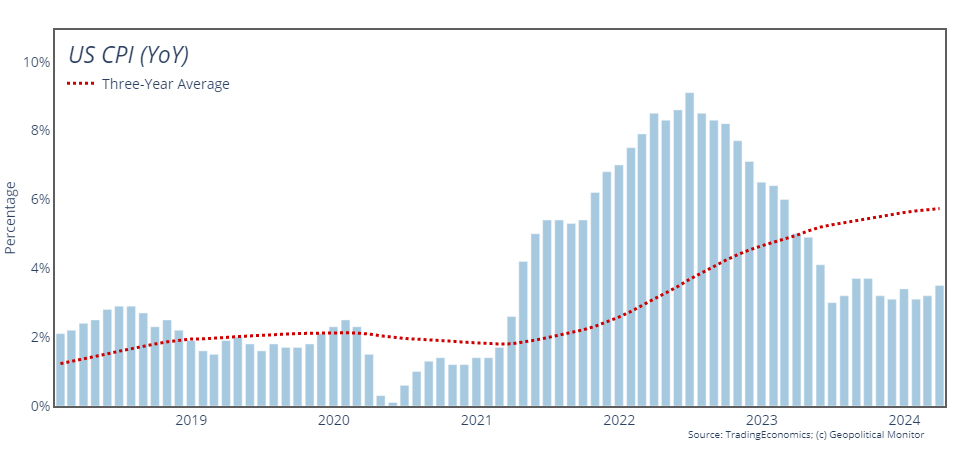

The latest CPI and PPI inflation data come at a critical juncture for the US Federal Reserve. On the one hand, the US stock market was recently hovering near all-time highs and jobs data shows no signs of retreat from a 3.8% unemployment rate. On the other, the March data shows that inflation remains well off the Fed’s 2% target and continues to trend in the wrong direction. Moreover, inflation remains a particularly sensitive political issue ahead of November elections, with a recent Gallup poll citing cost-of-living as the foremost concern of likely voters.

The data, with CPI surprising on the upside and PPI on the downside, will complicate the Fed’s path to easing, and many are now betting heavily against a cut in the Fed’s June meeting. The Fed will be under pressure to adopt an aggressive anti-inflation stance through to November at the very least – a policy that translates into higher interest rates and a stronger US dollar. These monetary forces will resonate outside the borders of the United States as well, inducing capital flight from emerging markets and increasing the servicing costs of debt-distressed states that have borrowed heavily in USD.