How does the West stand in the ‘Cold War 2’ contest with China for allies in the Global South? The straightforward answer is: poorly.

Why?

China decided to instrumentalize its overseas reserves in 2013 by announcing the Belt and Road Initiative (BRI) and putting its overseas assets to sharper geopolitical application, shifting the mix from foreign exchange reserves to overseas lending and direct investment. The economic cost has been high because the yield from China’s overseas assets has not increased to match the new assets mix’s higher financial and liquidity risk. The opportunity cost of this re-orientated overseas balance sheet is now running at about 1.5% of China’s gross domestic product.

Although China has managed to increase its soft power among ruling elites in many countries, especially in the Global South, this can prove fleeting, as the Philippines demonstrates when underlying national interests are not aligned.

China has reoriented its trade toward less geopolitically distant countries, such as Russia, but at the expense of augmenting its geopolitical distance from liberal democracies. However, it remains dependent on liberal democracies as export destinations and for the supply of some critical goods, including technology, food, and iron ore.

Meanwhile, the European Union announced its Global Gateway in 2021 and the United States announced its Build Back Better World and Indo-Pacific Economic Partnership, as well as the G7’s Partnership for Global Infrastructure and Investment and Blue Dot Network, as responses and attempts to emulate China’s BRI.

Is emulating Belt and Road compatible with a liberal political economy?

The BRI’s root lies in two key features of China’s political economy: First, the perennial savings surpluses China has run since 1993 mean that it is necessarily a net exporter of capital to the rest of the world. Second, China’s fixed/managed exchange rate regime and the tight control the party-state exercises over its economic agents means that foreign exchange earnings can be directed by the party-state to whatever ends it deems fit.

Neither of these conditions hold true for the United States nor liberal democracies more generally. Besides, BRI was conceived because it played to China’s existing strengths and requirements. For example, the over-supply of construction materials could potentially be solved by channeling the surplus to construction projects. The expertise and scale that China’s construction companies had acquired through domestic infrastructure building could be used overseas. Also noteworthy is BRI’s success as an enabler for other state-set objectives. Industrial policy has been key to the dominance of alternative energy equipment. For example, the sale of alternative energy equipment has been promoted through BRI-related financing of projects overseas.

The lack of savings surplus (current account surplus) does not preclude the U.S. from investing more abroad, but it does mean such investment needs to be financed by the sale of more US assets to foreigners. The alternative is to reduce domestic investment by a corresponding amount. Given that US investment is running at just 22% of GDP (China is at 44% of GDP) this might not be desirable. Currently, China saves more than the U.S., Japan, and Germany combined. The U.S., or rather US companies and individuals, own $34 trillion of overseas assets. Foreigners own $54 trillion of US assets leaving the country with a net international investment deficit of $20 trillion. Despite this imbalance, income from US-owned overseas assets exceeded the income paid on the much larger pool of foreign-owned assets in the U.S. by about $140 billion in 2023. It is so because the profit-maximizing US companies investing overseas are generating higher returns than foreign investors in the U.S. This in turn reflects the passive nature of much foreign investment in the U.S. which represents foreign exchange reserves holdings of low-yielding debt instruments. The imbalance in returns on investment is a major factor in funding America’s trade deficit in goods, allowing US consumers to spend more and save less than they otherwise might. A BRI-type approach to overseas investment downplaying financial return in favor of geopolitical return would put consumer welfare at risk.

Emulating BRI would be a further step toward mimicking the behavior of China. Resources would be diverted from profit-maximizing opportunities and toward geopolitically inspired ones, potentially against a backdrop of government expenditure already amounting to 39% of GDP in the U.S. and 49% in the European OECD members.

Then what are the liberal democracies already doing?

Existing Development Assistance: China vs. DAC Countries

According to data from the OECD, the 32 Development Assistance Committee (DAC) members spent $223 billion on Official Development Assistance (ODA) in 2023, up from $211 billion in 2022. The DAC members broadly constitute the liberal democracies of the world, including Japan and South Korea, Australia and New Zealand, Western European nations, and the U.S. and Canada. Since 2015, the DAC countries have contributed about $1.5 trillion in ODA.

These ODA transfers pass through the current account of the balance of payments and, therefore, do not give rise to an asset in the international investment position. From a balance of payments perspective, they are like imports in that they represent a cash outflow with no corresponding asset. In contrast, BRI investment or lending for project financing goes through the capital account, with the loan or ownership of the asset being a Chinese-owned foreign asset in the international investment position.

The total private flows and official flows from DAC member countries to the Global South since BRI’s inception in 2013 have amounted to more than $4.75 trillion, roughly split into $2 trillion of grant-like assistance and $2.75 trillion of private, profit-maximizing flows.

These amounts are in stark contrast to China’s spending and investment in the Global South. The total Chinese share of $70 billion is a small fraction of the $1.5 trillion that has come from the DAC countries within ODA.

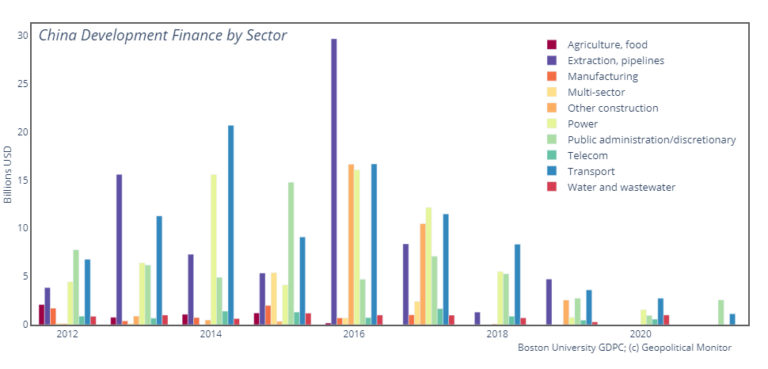

Otherwise, the majority of flows from China to developing countries are in the form of state-led financing and FDI through state-owned financial institutions or state-owned enterprises (SOEs). These are quasi-commercial flows but with a holistic approach to measuring their worth to China’s economy, considering national resilience, regional policy, and geopolitics. According to AidData, between 2015 and 2021, Chinese entities financed just fewer than ten thousand projects to the tune of just more than $500 billion. Add to this the increase in the stock of FDI in BRI countries, which has increased from about $115 billion in 2015 to about $250 billion by the end of 2023, an increase of about $135 billion. Therefore, the total flow from China toward the Global South seems to be about $700 billion from 2015 to 2023.

The conclusion, then, is that Chinese financial flows of ODI, lending, and FDI toward the Global South have totaled approximately $700 billion to $800 billion since 2015, compared to $4.75 trillion from DAC countries.

This begs the question: Why does China’s influence appear to be growing dramatically when its financial flows are about 15% of the flows coming from DAC countries?

Is China getting more value for its money, even as a holistic partner?

There is a general perception that China’s influence in the Global South has risen substantially in the last ten years while that of Western democracies generally, and the U.S. in particular, have seen their influence fall. This perception is supported by the increasing willingness of developing countries to act independently of the wishes of the U.S. and OECD countries more generally. For example, countries containing 85% of the world’s population have not imposed sanctions on Russia following its invasion of Ukraine, despite the stated desire of both the U.S. and the EU to do so.

The most obvious change in the past decade has been the relative economic rise of China and the scale of its engagement with the developing world through BRI. Therefore, it is tempting to conclude that one has caused the other— that China’s economic rise has led to more sway over the Global South. There are of course many reasons that could explain China’s relative rise in influence other than BRI. The global financial crisis of 2008 served to discredit the Anglo-Saxon economic model in the eyes of some. The Eurozone debt crisis and the stagnation of the European economy has arguably diminished the prestige of the continent. Aside from economic reasons, US military action in Iraq and Afghanistan alienated some in the Global South. The subsequent failure of the missions can easily be interpreted as weakness and potentially calls into question the dependability of the U.S. as an ally. Political divisions within Western democracies, rather than being viewed as a source of strength, indicate weakness, decadence, or even a failing system to some. According to Human Rights Watch, some 67 countries in the developing world have legal bans on same-sex marriage; the so-called progressive social agendas in the West hardly sit well with such attitudes. China’s amoral approach to economic engagement with developing countries – or the “no-strings-attached” policy – is readily received in countries whose value systems look increasingly at odds with those advocating liberal policies in the West.

In short, it is hard to isolate the economy from the political, social, and geopolitical trends that have diminished Western influence relative to China’s in the Global South. Having said that, one might think that China’s role in the COVID pandemic, responsible for seven million deaths around the world, and its refusal to cooperate in both containing the virus and establishing its source would have diminished China’s standing in the world too. In addition, China has border or maritime disputes with 15 countries where its increasing assertiveness is damaging its image. Furthermore, several BRI projects have backfired from a propaganda perspective, either proving uneconomic or sub-standard in terms of construction and planning.

Perhaps the perceived growth of Chinese influence in the Global South is overstated and what we are witnessing is countries in the Global South simply asserting their own national interests more forcibly. This newfound reality is leading to the perception that others are gaining influence because the interests of countries in the Global South do not always coincide with that of the U.S. or the Western world more generally. If this is the case, then the idea that emulating BRI with a similar but better program will, on its own, induce greater compliance is most likely misguided. A better approach for the West would be to focus on aligning interests more closely.

A Path Forward for the West

To the extent that BRI has helped developing economies increase their connectivity to the world – and not just China – BRI has potentially helped the West in its search to diversify sourcing of manufacturing away from China.

Three objectives seem to fit within the likely remit: First, inducing and facilitating the migration of manufacturing from China to other countries in the Global South can diminish liberal democracies’ dependence on imports from China. Second, ensuring adequate access to raw materials, the supply of which is dominated by countries in the Global South. Finally, ensuring that Western companies are not disadvantaged in their efforts to sell to the Global South.

The common denominator in the Global South countries is the need to improve their economic performance to raise living standards and a desire for national sovereignty. This is in stark contrast to the 2002-2012 period, i.e., the pre-BRI years when their share in the world GDP increased from 14.8% to 27.4%, while after 2013, no further such growth was registered (as per the World Bank database). The West should address the issue, as obviously the trillions of US dollars spent for Global South countries’ support did disappointingly little for world democracy.

The United States and the EU should find ways to combine effectively their own needs for re-industrialization with the industrialization of countries in the Global South by structuring new (alternative) supply chains. Investment in these chains and thus outmuscling China in the region will be crucial for the near- and friend-shoring strategies’ success. Assistance could also come from additional comprehensive trade agreements, which together would help define the key trade, financial, and environmental protection mechanisms of the near- and friend-shoring. These agreements could provide a simplified level of access for Global South companies to Western markets. The latter may need to make concessions on employment in the West, but in the longer run, this would reduce the Cold War 2 inflationary pressures on Western economies and diversify many deliveries to their market agents at the expense of China.

The views expressed in this article belong to the author(s) alone and do not necessarily reflect those of Geopoliticalmonitor.com.